tax loss harvesting example

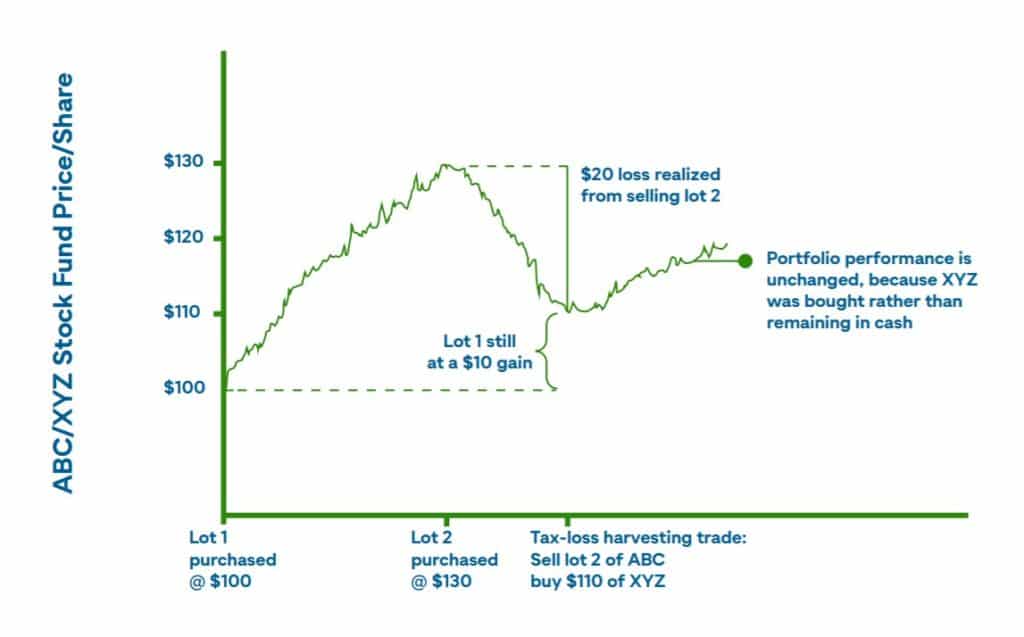

Tax-loss harvesting as it is known allows investors to offset gains realized in one investment. Tax loss harvesting example.

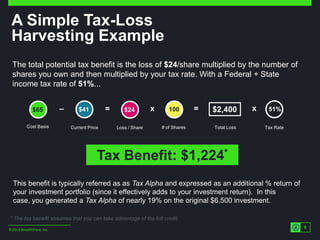

A Simple Tax Loss Harvesting Example

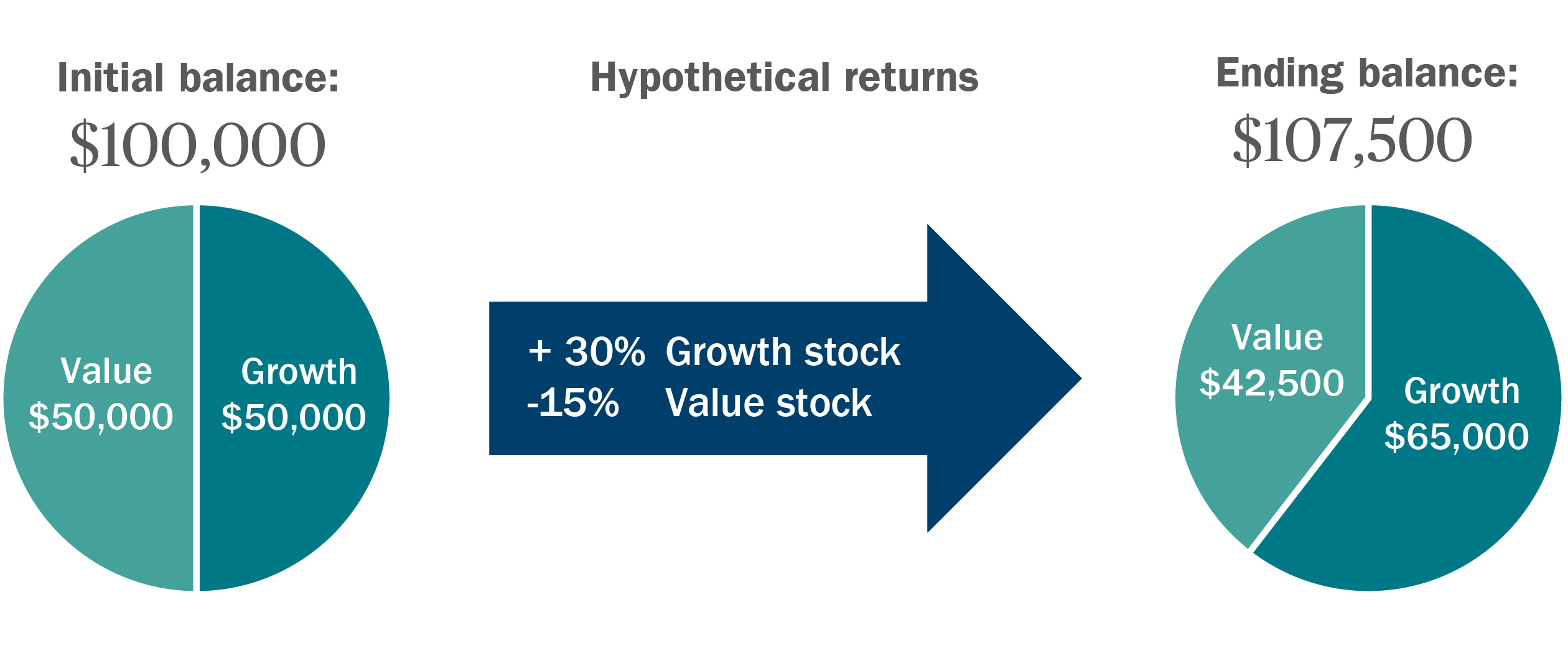

By realizing or harvesting a loss investors can offset taxes on gains and income.

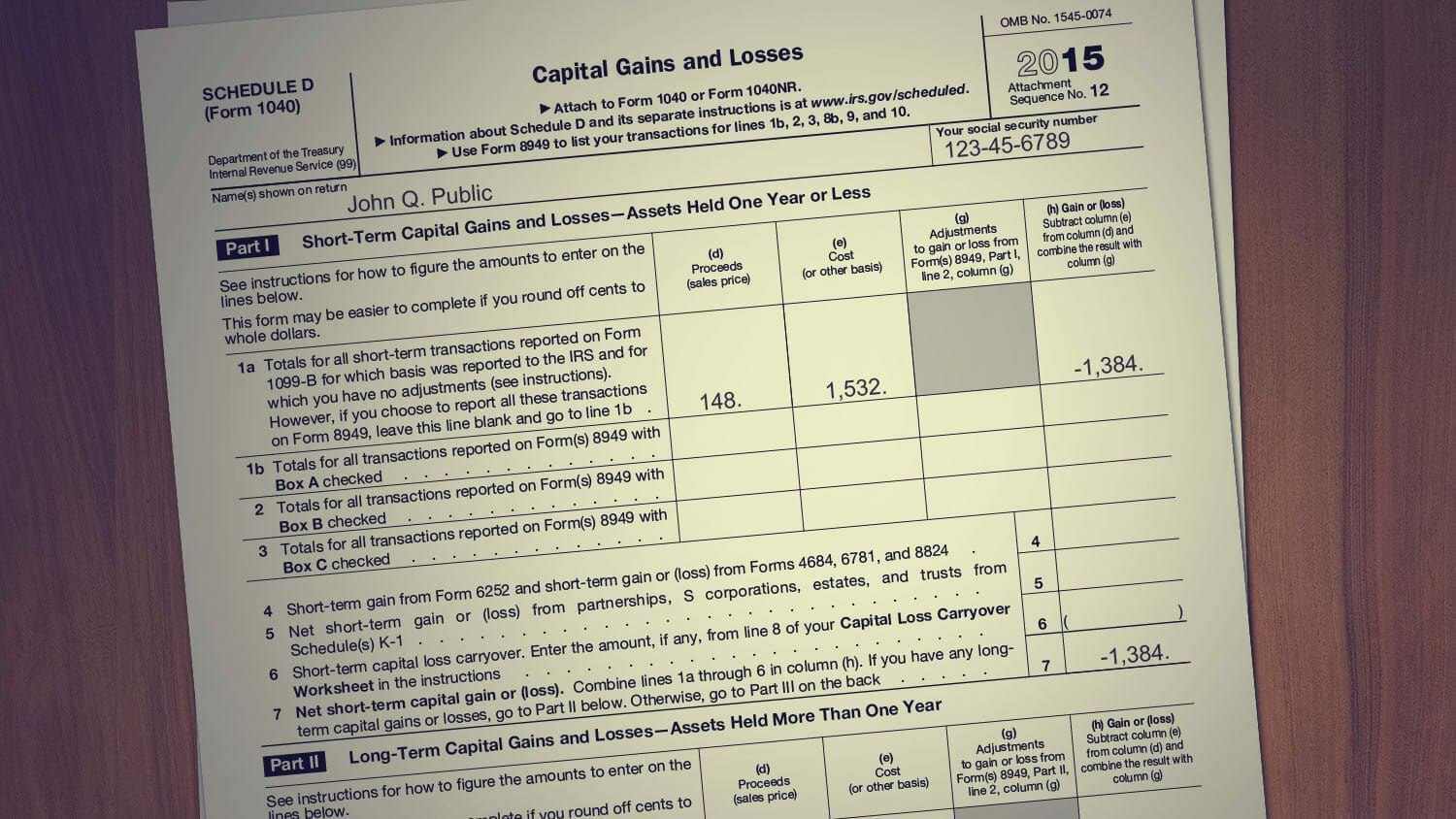

. Tax losses are harvested as you sell investments for a capital loss or gain. Tax-loss harvesting can be valuable to an individual who invests in taxable brokerage accounts as a means of either. Tax Planning Checklist Step 2.

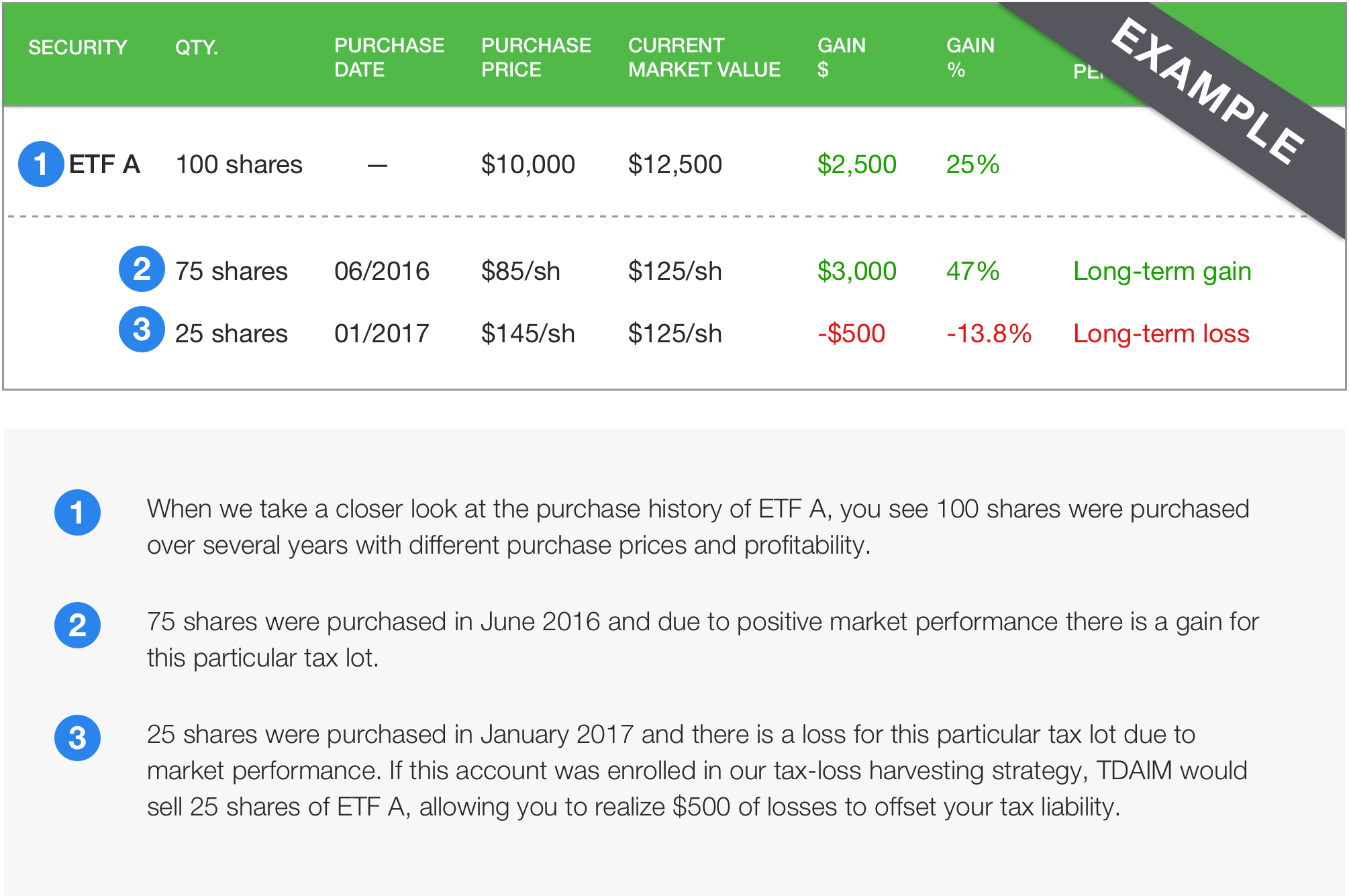

An Example of Tax-Loss Harvesting. Each year youre allowed to use harvested losses to offset up to 3000 of ordinary income so you could apply 3000 of your remaining losses against the money you made at. Tax-loss harvesting to diversify out of a concentrated stock position.

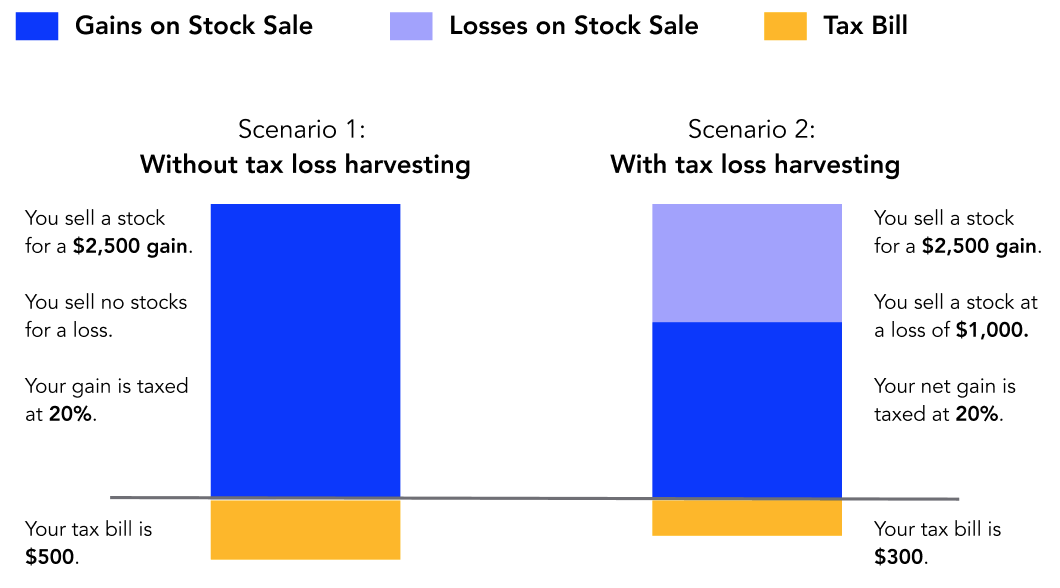

Lets look at an example. Your 25000 loss would offset the full 20000 gain from Investment A meaning youd owe no taxes on the gain and you could use the remaining 5000 loss to offset 3000. Tax Planning Checklist Step 3.

Lets suppose that you had purchased 10000 of a popular SP 500 ETF in mid-February of 2020 when it was at a high of 33760. This is a making-lemons-out-of-lemonade kind of situation. Tax-Loss Harvesting Example For example lets say that you purchase 10000 shares of two different individual stocks Stock A and Stock B for the price of one dollar per.

In addition if you have more losses than you do gains you can take up to 3000 and thats the maximum of those losses and use those to offset other ordinary income. Don can take a loss on paper which will at least have the benefit of reducing his tax bill. Unlike the last example where losses were being harvested solely for tax savings if an investor is looking.

Tax loss harvesting example Lets say Peter buys 100 shares of a utility stock call it stock ABC at 10 per share or 1000 invested. Analyze Opportunities for Roth Conversions. The good news is that losses may come with a silver lining in the form of potential tax benefits.

Definition and Example of Tax-Loss Harvesting. After a few months stock ABC falls to 6 per. Elect to sell Investment B which generates a 15000 long-term loss.

Proactively Tax-Gain and Tax-Loss Harvest. Heres a more detailed example of how to tax loss harvest inside a taxable account. Because of tax loss harvesting your gain and loss offset each other to generate a net long-term gain of 15000.

Mortgage Interest Tax Deductions May Get Extra Scrutiny This Year The following example. If you sold an investment property youd owned for less than 12 months and realized a profit that profit would be subject to short-term capital gains tax.

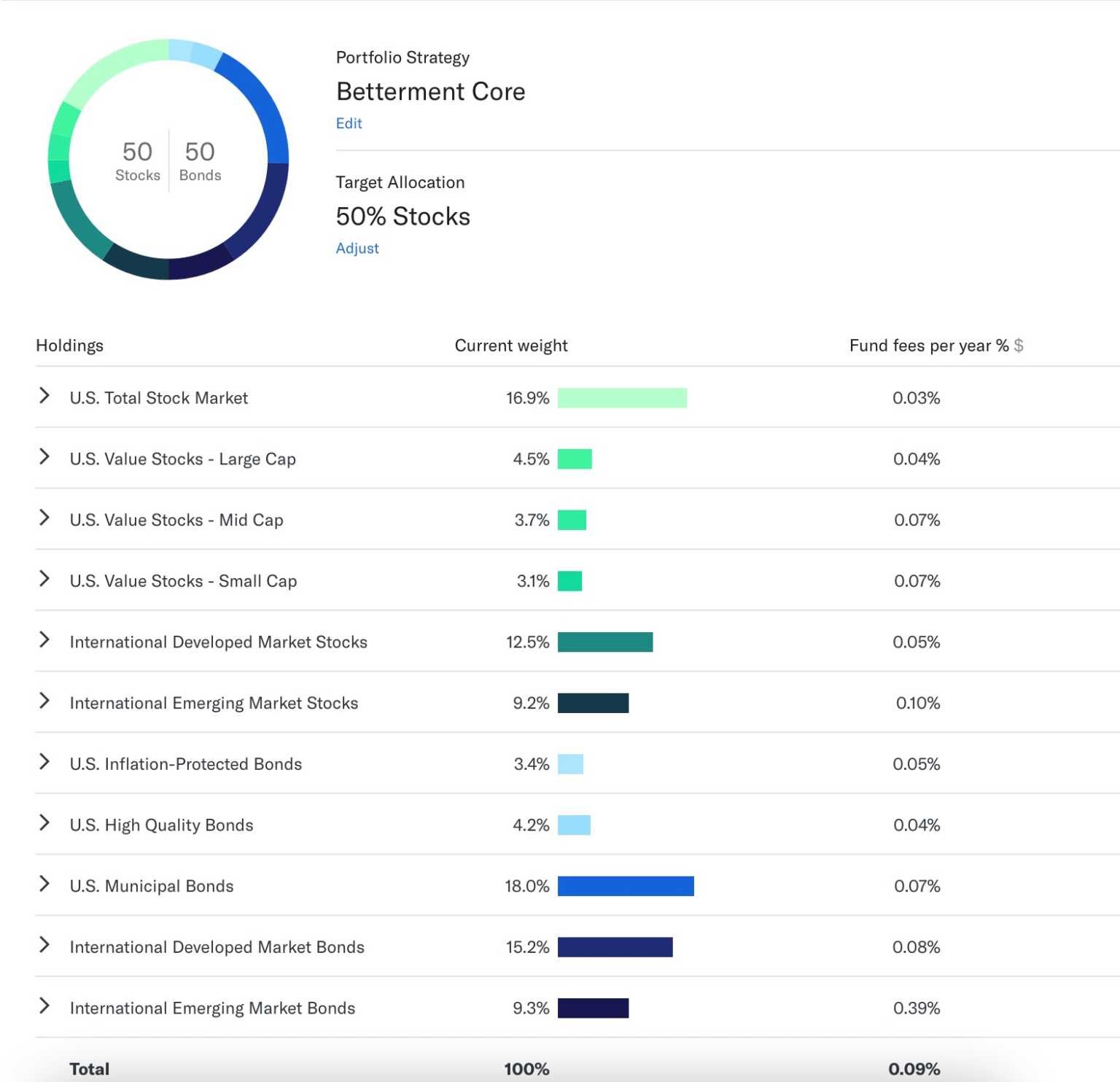

Tax Loss Harvesting Methodology

Your Guide To Tax Loss Harvesting Season By Reconcile

A Quick Guide To Tax Loss Harvesting Benzinga

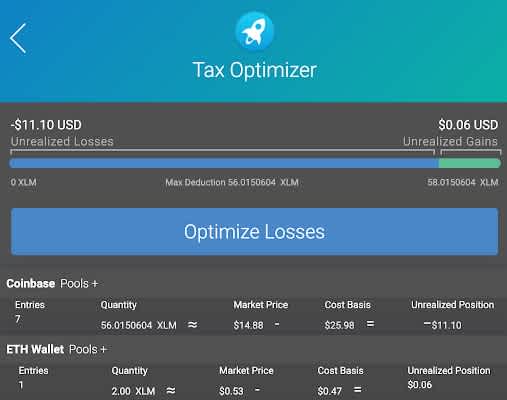

Crypto Tax Loss Harvesting A Complete Guide Taxbit

Tax Loss Harvesting For Taxable Accounts Charis Legacy Partners

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

Tax Loss Harvesting More Than A Year End Tax Strategy

Tax Loss Harvesting What Is It Rules Example Benefits

Tax Loss Harvesting Capital Loss Deduction Td Ameritrade

Tax Loss Harvesting With Vanguard A Step By Step Guide Physician On Fire

Turning Losses Into Tax Advantages

Tax Loss Harvesting Guide 2022 Beat Capital Gains

How Tax Loss Harvesting Can Reduce Your Tax Bill Personal Capital

.jpg)

The Ultimate Guide To Cryptocurrency Tax Loss Harvesting Coinledger

What You Need To Know About Tax Loss Harvesting Ameriprise Financial Ameriprise Financial