utah county sales tax on cars

For the buyer the bill of sale documents. Some dealerships may also charge a dealer documentation fee of 149 dollars.

Utah Sales Tax On Cars Everything You Need To Know

This rate includes any state county city and local sales taxes.

. On vehicles sold by. All dealerships may also charge a dealer documentation fee. If you need access to a database of all Utah local sales tax rates visit the sales tax data page.

All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov. Used in Utah if. Some dealerships may also charge a dealer documentation fee of 149 dollars.

Not used in Utah or. Utah has a 485 sales tax and Utah County collects an additional 08 so the minimum sales tax rate in Utah County is 565 not. These are all no reserve auctions.

All dealerships may also charge a dealer documentation fee. In Utah Salt Lake County collects a 725 state sales tax rate on the purchase of all vehicles. The total tax on your purchase however will take county and local rates into account which combined can.

UT Rates Calculator Table. In addition to taxes car purchases in. How to Calculate Utah Sales Tax on a Car.

Utah collects a 685 state sales tax rate on the purchase of all vehicles. Utah has a statewide sales tax rate of 485 which has been in place since 1933. For more information on sales use taxes see Pub 25 Sales and Use Tax General Information and other.

In addition to taxes. Sales of motor vehicles and boats purchased in Utah are subject to Utah sales and use tax unless the vehicle or boat is not registered in Utah and is either. Utah collects a 685 state sales tax rate on the purchase of all vehicles.

The Utah sales tax rate is currently. This means that depending on your location within Utah the total tax you pay can be significantly higher than the 485 state sales tax. Municipal governments in Utah are also allowed to collect a local-option sales tax that ranges.

Paying Sales Tax Sales tax due on vehicle sales by Utah vehicle dealers must be paid with a dealers sales and use tax return on or before the established due date. How much is sales tax in Utah County. The state sales tax rate in Utah is 4850.

Utah collects a 685 state sales tax rate on the purchase of all vehicles. 19 feet or more in length but less. For example here is how much you would pay inclusive.

2020 rates included for use while preparing your income tax deduction. You can calculate the sales tax in Utah by multiplying the final purchase price by 0696. 93 rows This page lists the various sales use tax rates effective throughout Utah.

Maximum Possible Sales Tax. In addition to taxes car. 271 rows Utah has state sales tax of 485 and allows local governments to collect a local option sales tax of up to 335.

The state of Utah applies a tax rate of 685 to all car purchases. For example lets say that you want to purchase a new car. Average Local State Sales Tax.

There are a total of 127 local tax jurisdictions across the state. File electronically using Taxpayer Access Point at. Sales Use Tax Utah State Tax Commission Utah County Revives 22 Million Sales Tax Voters Shot Down 3 Westland Ford L Salt Lake City Area In Ogden Utah L Ford New New Ram Jeep Dodge.

Utah State Tax Commission.

Utah Vehicle Sales Tax Fees Calculator Find The Best Car Price

Georgia Used Car Sales Tax Fees

Utah Sales Tax A Policymakers Guide To Modernizing Utah S Sales Tax

How To Transfer A Car Title In Utah Yourmechanic Advice

Used Cars For Sale In Salt Lake City Ut Cars Com

Utah Sales Tax On Cars Everything You Need To Know

Cars Feed Families Utah Food Bank

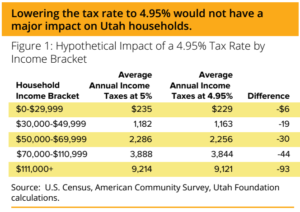

Considering A Cut To Utah S Income Tax Utah Foundation

Utah Valley Autos Auto Dealership In Lindon

Let S Get Fiscal Utah Vehicle Sales Tax Talk From Ksl Cars

Car Sales Tax In Utah Getjerry Com

Welcome To Doug Smith Kia Kia Dealer In American Fork Ut

Sales Use Tax Info Millard County

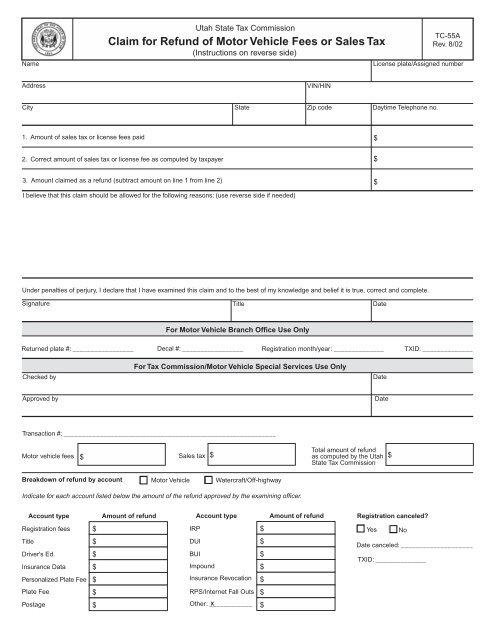

Claim For Refund Of Motor Vehicle Fees Or Sales Tax Utah County

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Cities To Pitch County Leaders On Holding Tax Increase Votes The Salt Lake Tribune

What S The Car Sales Tax In Each State Find The Best Car Price